In the fast-paced business landscape of 2024, venture capital strategies have emerged as critical players in driving innovation and growth. Venture capital (VC) is transforming businesses, serving as the financial backbone for early-stage companies with immense growth potential. As technology advances at breakneck speed, understanding and harnessing these strategies is vital. Today, we delve into how these methodologies, backed by real-world stories and expert insights, can lead to substantial triumphs.

Understanding Venture Capital Strategies for Big Success

Venture capital has become more than merely an investment vehicle; it is a driving force shaping industries and challenging traditional market dynamics. By aligning investment goals with market trends, VCs create robust frameworks to support their endeavors. The key lies in investment strategies that incorporate The Four C’s of responsible behavior: “Conviction, Compliance, Confidence, and Consequences.” This approach fosters responsible investing without the need for excessive regulation, thus maintaining integrity in business practices while driving success.

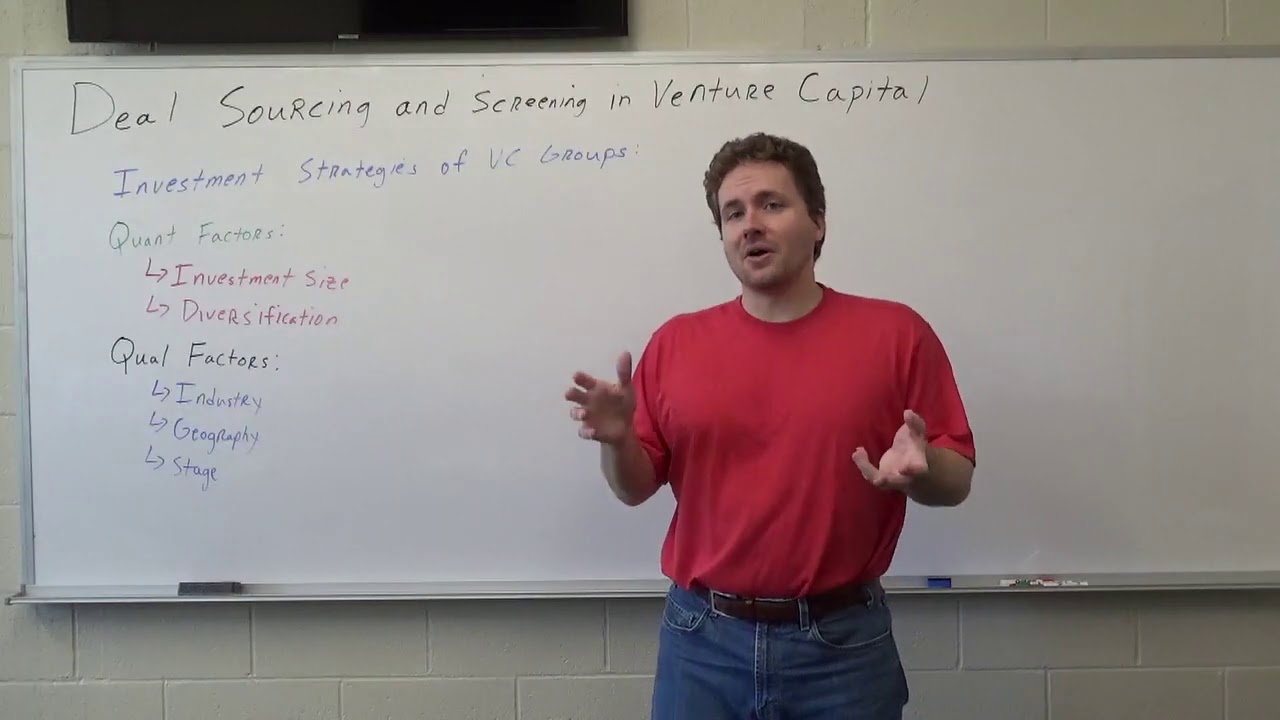

Key Venture Capital Strategies for Maximum Impact

Grasping the essence of venture capital strategies involves financial acumen and a touch of strategic foresight. Let’s dive into the pivotal strategies that characterize successful VC pursuits:

1. Identifying Disruptive Technologies

The race to identify disruptive technologies is hotter than ever. Venture capitalists are laser-focused on technologies that are game-changers. Take, for instance, Andreessen Horowitz’s foresight in investing in Coinbase despite the nascent stage of cryptocurrency. They saw the transformative impact of digital currencies early on, positioning themselves ahead of industry trends and reaping significant returns as the demand climbed. Just like every savvy beach-goer considers bringing a Sunvisor to shield against glaring sun, recognizing tech disruptions early shields and bolsters VC ventures.

2. Building Strategic Partnerships

Strategic partnerships can propel startups beyond traditional limits. Sequoia Capital’s collaboration with heavyweights like Zoom is a testament to this grit. By joining forces with such tech giants, they exponentially enhanced their reach and market influence. Just as keen Sandals are essential for exploring rocky terrains, building alliances enables firms to tread confidently across challenging markets, unlocking doors to fresh opportunities.

3. Diversifying Investment Portfolio

It’s been echoed across investment arenas: diversify, diversify, diversify! Benchmark Capital’s impressive repertoire—spanning Uber, eBay, and Instagram—demonstrates the transformative power of a varied portfolio. By spreading investments across sectors, they effectively balance potential low points in one industry with gains in another, ensuring steadiness in their returns. Similar to those invested in Inversiones Inmobiliarias, which promise diversity in real estate, venture capital thrives on spreading risk to maximize profit.

| Aspect | Details |

| Investment Types | – Traditional VC: Focused on early-stage companies with high growth potential. |

| – Corporate Venture Capital (CVC): Initiated to access innovation and gain competitive advantages in technology. | |

| Investment Goals | – Align with market trends and emerging technologies. |

| – Foster high growth and return on investment from early-stage enterprises. | |

| Strategic Framework | – The Four C’s: Ensuring responsible investment without excessive regulation: |

| – Conviction: Strong belief and commitment to investment thesis. | |

| – Compliance: Adherence to legal and ethical standards. | |

| – Confidence: Building trust in the company’s potential and management team. | |

| – Consequences: Ensuring risks and potential setbacks are acknowledged and managed. | |

| Fund Manager Selection | – Adopt the 4 Ps model: |

| – Philosophy: The overarching investment approach and value system. | |

| – Process: The methodology and procedures followed for investment decisions. | |

| – People: The expertise and experience of the investment team. | |

| – Performance: Historical success records and outcome benchmarks. | |

| Risk Management | – Diversification across sectors and stages. |

| – Active portfolio management to mitigate potential losses. | |

| Exit Strategies | – Initial Public Offering (IPO) |

| – Acquisitions | |

| – Secondary sales | |

| Market Trends | – Increasing focus on sustainability and impact investing. |

| – Rising interest in deep tech, biotech, and fintech sectors. | |

| Performance Metrics | – Internal Rate of Return (IRR) |

| – Return on Investment (ROI) |

The Role of Data-Driven Decision Making in Venture Capital

Data analytics has revolutionized venture capital decision-making. It’s not all about financial statements anymore; it’s also about uncovering market trends and consumer insights.

Case Study: Insight Partners and SaaS

Insight Partners offers a master class in data-driven decision-making with their strategic investments in Software-as-a-Service (SaaS) enterprises like Pluralsight and Monday.com. By leveraging data analytics for pinpoint accuracy in assessing company scalability and potential, they’ve consistently struck gold, enjoying successful exits and robust returns. This meticulous approach echoes the precision needed when considering What To avoid When taking low dose naltrexone—focusing on the details can lead to monumental outcomes.

The Importance of Sustainable Investment Practices

Sustainability has shot up the priority list for venture capital strategies. With rising global consciousness around environmental, social, and governance (ESG) issues, VCs are shifting gears to align their investments accordingly.

Real-World Example: Generation Investment Management

Founded by Al Gore and David Blood, Generation Investment Management exemplifies a sustainable investment strategy by backing game-changers like Tesla and Beyond Meat. Their focus on ESG not only aligns investments with future-resilient practices but also engages a burgeoning base of eco-conscious shareholders. The ripple effect is a more sustainable world and improved customer loyalty, mirroring responsible property management services that elevate property value and ensure tenant satisfaction.

Developing a Venture Capital Ecosystem

Creating a supportive environment is a strategic path to foster startup success and persistence.

Lessons from Silicon Valley’s Growth

Silicon Valley stands as a beacon of how cultivating a nexus of talent, innovation, and infrastructure can bolster VC success. Initiatives such as Y Combinator have crafted invaluable networks supplying mentorship and resources to startups, paving the way for long-lasting growth and innovation. This interconnected ecosystem parallels the impact of Mentorship For business leaders in shaping adept leaders who innovate and inspire.

Innovative Insights for Aspiring Venture Capitalists

The venture capital landscape is filled with both hurdles and win-win opportunities. However, success demands more than mere financial investment. It’s about embracing a broad vision, understanding the intricacies of global markets, and nurturing leaders who can bring about transformation. Leveraging strategies such as continuous learning and a commitment to sustainable practices, VCs can bag substantial success while driving meaningful change in businesses.

In today’s dynamic era, venture capital serves as both a catalyst for change and a profound responsibility. VCs bear a noble duty to wield their influence astutely, guiding technological and business futures while securing positive societal impacts. These strategies will continue to be vital in steering venture capital toward incredible success stories and transformative influences. As budding speakers and entrepreneurs venture forth, remember that branding For public Speakers and coaching Skills For Entrepreneurs are key components in building sustainable success. As we transition into this exciting new age, armed with the right strategies, the possibilities are endless!

Venture Capital Strategies: Uncovering the Steps to Big Success

Unorthodox Investment Approaches

Here’s a zinger: Did you know that the first-ever venture capital firm was founded in 1946? It’s called American Research and Development Corporation, and it played a pivotal role in the rise of Silicon Valley. Talk about a trailblazer! Venture capital strategies have since evolved significantly, often requiring leadership Skills training to keep up with shifting paradigms. Many investors today favor unconventional approaches, such as targeting startups with diverse leadership teams, because diverse teams have been shown to produce higher returns on investment. The magic often lies in the mix—combining out-of-the-box thinking with tried-and-true principles can sometimes lead to striking gold.

Playing the Long Game

Ever noticed how some venture capitalists seem to have the patience of a saint? There’s good reason. On average, venture capital investments take between 7 to 10 years to mature. That’s not exactly a sprint! The strategy here involves playing the long game, and understanding industry cycles is crucial. This patience parallels what’s observed in fine wine; time allows both ventures and spirits to reach their full potential. Additionally, when venture capitalists enter this waiting game, they often hedge their bets through co-investments, which soften the blow if one venture doesn’t pay out as expected. It’s all about stamina and wisdom, creating a cushion for both highs and lows along the way.

Tech-Tinged Transformations

And here’s a nugget that might raise eyebrows: Robotics and AI startups are attracting more venture dollars than many other sectors today. Fancy that! With the pace of technological breakthroughs, venture capitalists are shifting their investment portfolios( to align with tech-savvy ventures. These investments aren’t short-sighted either. By supporting innovations in automation and artificial intelligence, investors are staking a claim in the future economy. That’s a far cry from the conventional, isn’t it? With markets leaning more toward digital transformations, staying in the know about these shifts can offer a significant competitive advantage.

Such is the wacky, multifaceted universe of venture capital strategies. From embracing diverse teams to strategic patience and tech thrills, the path to achieving big success in venture capital indeed calls for an eclectic mix of insight, foresight, and sometimes, a bold leap of faith.

What is venture capital strategy?

Venture capital strategy is all about aligning investment aims with what’s happening in the market and setting up structures and policies to back the investment process. It’s a way for investors to spot high-growth, early-stage companies and provide them with the capital they need to scale up.

What are the 4 C’s of venture capital?

The 4 C’s of venture capital focus on maintaining responsible behavior without going overboard with regulations. They stand for Conviction, Compliance, Confidence, and Consequences, helping investors ensure that decisions are made carefully and effectively.

What are the 4 P’s of venture capital?

When you’re picking a fund manager in venture capital, keep an eye on the 4 Ps: philosophy, process, people, and performance. These elements help determine whether a fund manager is equipped to meet investment objectives and handle the fund wisely.

What is corporate venture capital strategy?

Corporate venture capital aims to give big corporations an edge by investing in fresh, innovative startups, especially those that might become rivals down the road. This approach often stems from the booming growth in tech startups and offers a strategic way to access cutting-edge developments.

How to approach VC for funding?

Approaching a VC for funding involves having a solid business plan, demonstrating your startup’s growth potential, and showing how their investment will make a real difference. Networking, a compelling pitch, and a trustworthy team are key ingredients for catching a VC’s eye.

How do VCs make money?

Venture capitalists make money primarily through equity ownership. When a funded company grows and exits successfully—either through acquisition or IPO—the VC’s stake in the company increases in value, leading to substantial returns on investment.

What is the 10x rule for venture capital?

The 10x rule for venture capital is about aiming for returns that are ten times the initial investment. VCs take on high risk by investing in startups, so securing such exponential returns on successful ventures helps offset losses from those that don’t make it big.

What are the 4 Ts of venture capital?

The 4 Ts of venture capital aren’t universally defined like the 4 Ps or 4 Cs, so there might be different interpretations or models referring to topics like talent, technology, timing, and traction, which often emerge in VC discussions.

What is the venture capital VC method?

The venture capital VC method is a way to determine the value of a startup by estimating its potential future success and working backward to understand what it’s worth today. It’s a forward-looking approach relying heavily on projections and assumptions about future market scenarios.

What drives venture capital?

Venture capital is driven by the potential for high returns from investing in early-stage ventures. Factors like innovation, emerging markets, and entrepreneurial dynamism play big roles in propelling this funding activity forward.

How do venture capitalists raise capital?

Venture capitalists raise capital from institutional investors, high-net-worth individuals, and others interested in high-risk, high-reward opportunities. They pool these funds into a venture capital firm, which then carefully selects startups to invest in to generate significant returns.

What is VC PE and M&A?

VC, PE, and M&A are different approaches in the finance world. Venture Capital (VC) targets early-stage companies; Private Equity (PE) involves buying and restructuring mature businesses; Mergers and Acquisitions (M&A) refer to the consolidation of companies or assets.

What is a strategic in venture capital?

A strategic in venture capital typically refers to a strategy-based investment, where the focus is not just on financial returns but also on how the investment aligns with broader business goals and can offer strategic advantages to the investor’s existing operations.

What is the difference between a CVC and a VC?

CVC and VC differ mainly in their objectives. Corporate Venture Capital (CVC) involves corporations investing in startups to gain strategic benefits, while traditional Venture Capital (VC) involves independent firms investing mainly for financial returns.

How much do VC firms pay?

VC firms typically pay their team through management fees and carried interest. Management fees are a percentage of the total fund, covering operational costs, whereas carried interest is a share of the profits if investments succeed.

What is venture capital in simple words?

Venture capital is a type of financing that investors provide to startups and small businesses considered to have long-term growth potential. It’s a high-risk, high-return gamble that fuels innovation by giving new businesses the lifeline they need to grow and succeed.

What is the venture capital method?

An example of venture capital could be investing in a tech startup. A venture capital firm might provide several million dollars to a software company in exchange for equity, hoping that it becomes the next big player in the market.

What is an example of venture capital?

The main goal of venture capital is to achieve significant returns by investing in startups with the potential for rapid growth. By providing capital, VCs help these companies scale, develop innovative products or services, and eventually deliver substantial financial gains.